- Posts: 93768

- Thank you received: 44

Trump and Muslim Ban |

02 Feb 2017 18:53 #334279

by ketchim

Spencer said the Israeli expansion is not helpful !

White House just put out their statement to that effect !

Spencer said the Israeli expansion is not helpful !

White House just put out their statement to that effect !

Please Log in or Create an account to join the conversation.

- TRINIDADDY

- Visitor

-

03 Feb 2017 09:37 #334299

by TRINIDADDY

Debt is basically encoded into the universe.

In physics we have something called thermodynamic laws. They say that energy can't be created or destroyed, just moved about. They also say that nothing can be created - no commodity, order, value of profit - without a greater disorder, debt, poverty or entropic heat loss.

So when you create something, it always embodies less energy than it took to make it. And since total energy in a system remains the same, that energy has to come from somewhere else. Something has to go into energy debt for the object to be made. Something has to go into energy debt for the equation to be balanced.

To further sell the object for more energy than it is worth - money is essentially an avatar of work and so caloric energy - means you have to take more energy from elsewhere in the system. So just by selling the commodity for a profit, you're forced to draw even more energy from elsewhere to balance your equations. You're forced to place an entropic debt on something or someone else.

Capitalists don't believe this. They believe in "infinite growth". Everyone can profit. Everyone can have infinite commodities and so energy. And they are right in some respects, because we have huge stores of "free energy" (oil, sunlight etc) and because value is subjective; someone may put a 100 dollar value on something that costs very little energy to make, and no value on something that requires alot of energy.

But none of those rationalizations apply to money itself. Money literally is zero sum at any fixed point in time. And because all money is created as debt with interest, all profit measured in monetary terms creates a greater debt and so poverty elsewhere.

You can't have a money economy and not have debt and the majority eventually indebted.

Capitalists ignore this by promoting something called a binary transaction fallacy. They believe that all transactions are simple, simply between A and B, both the buyer and seller profiting. But no transaction occurs in isolation, and every transaction affects everyone else in the system. Profit here, creates debt there. Money there, creates no money there.

So then people say: okay then, let's have debt jubilees! It worked in the past! Let's cancel all debts. But you can't cancel all debt today; all money is debt, you'd have to destroy everything.

People then say: fine, let's just destroy debts owed within a certain timeframe. But this ends up only benefitting the rich; the poor are lent less money and the biggest borrowers are the state and the rich. So debt jubilees are just big wealth transfers to them. And all your savings are somebody else's debt anyway, so that gets cancelled too.

So then people say: okay, let's have a debt jubilee, but only for the poor and the middle class. Nobody pays for student loads or medical bills over the next 5 years! But then whole chunks of the economy will pack up shop and stop doing business. You will have massive inflation, soaring business rates, and everything would cost more.

In the end, debt jubilees then become a means of preserving the system and pacifying people. But because it's so complicated to implement, what is more likely is governments implementing universal basic incomes, and paying for this with savings made from cutting welfare beuracracy. Finland is already trying this. The French elections this year have 2 left wing candidates who are proposing something similar. In 100 years time this may be common place, but in the long term will be just as unsustainable as anything we're doing now.

Debt is basically encoded into the universe.

In physics we have something called thermodynamic laws. They say that energy can't be created or destroyed, just moved about. They also say that nothing can be created - no commodity, order, value of profit - without a greater disorder, debt, poverty or entropic heat loss.

So when you create something, it always embodies less energy than it took to make it. And since total energy in a system remains the same, that energy has to come from somewhere else. Something has to go into energy debt for the object to be made. Something has to go into energy debt for the equation to be balanced.

To further sell the object for more energy than it is worth - money is essentially an avatar of work and so caloric energy - means you have to take more energy from elsewhere in the system. So just by selling the commodity for a profit, you're forced to draw even more energy from elsewhere to balance your equations. You're forced to place an entropic debt on something or someone else.

Capitalists don't believe this. They believe in "infinite growth". Everyone can profit. Everyone can have infinite commodities and so energy. And they are right in some respects, because we have huge stores of "free energy" (oil, sunlight etc) and because value is subjective; someone may put a 100 dollar value on something that costs very little energy to make, and no value on something that requires alot of energy.

But none of those rationalizations apply to money itself. Money literally is zero sum at any fixed point in time. And because all money is created as debt with interest, all profit measured in monetary terms creates a greater debt and so poverty elsewhere.

You can't have a money economy and not have debt and the majority eventually indebted.

Capitalists ignore this by promoting something called a binary transaction fallacy. They believe that all transactions are simple, simply between A and B, both the buyer and seller profiting. But no transaction occurs in isolation, and every transaction affects everyone else in the system. Profit here, creates debt there. Money there, creates no money there.

So then people say: okay then, let's have debt jubilees! It worked in the past! Let's cancel all debts. But you can't cancel all debt today; all money is debt, you'd have to destroy everything.

People then say: fine, let's just destroy debts owed within a certain timeframe. But this ends up only benefitting the rich; the poor are lent less money and the biggest borrowers are the state and the rich. So debt jubilees are just big wealth transfers to them. And all your savings are somebody else's debt anyway, so that gets cancelled too.

So then people say: okay, let's have a debt jubilee, but only for the poor and the middle class. Nobody pays for student loads or medical bills over the next 5 years! But then whole chunks of the economy will pack up shop and stop doing business. You will have massive inflation, soaring business rates, and everything would cost more.

In the end, debt jubilees then become a means of preserving the system and pacifying people. But because it's so complicated to implement, what is more likely is governments implementing universal basic incomes, and paying for this with savings made from cutting welfare beuracracy. Finland is already trying this. The French elections this year have 2 left wing candidates who are proposing something similar. In 100 years time this may be common place, but in the long term will be just as unsustainable as anything we're doing now.

Please Log in or Create an account to join the conversation.

- mapoui

- Topic Author

- Visitor

-

03 Feb 2017 11:22 - 03 Feb 2017 11:43 #334305

by mapoui

debtism is a contrivance...jewish banker debtism is

there are no permanent laws of physics/evolution..or as EU science refers to it at the monent.. as habits of nature, not laws.

then there is the question of survival: DEBTISM AS JEWISH BANKER SKEFF, MERCHANT OF VENICE AUSTERICIDE CRACK-POTTERY LEADS TO SOCIAL EXTINCTION. WHAT WILL THE PEOPLE CHOSE ON THIS DAY OF TECHNOLOGICAL ADVANCE WHEN REDUNDANCY IS THE KEY ::confused:: ::confused:: ::confused:: ::confused::

deb as some minor form of economic behavior relevant to temporary and urgent need and capped by common and official law to ensure it is non usurious has always been a social form.

any economy without debtism as its bases has always made the need for debt little but null. render unto society proper economies and debt is null.

I have not read dat argument fully yet..soon. but it looks full of holes to me

there are no permanent laws of physics/evolution..or as EU science refers to it at the monent.. as habits of nature, not laws.

then there is the question of survival: DEBTISM AS JEWISH BANKER SKEFF, MERCHANT OF VENICE AUSTERICIDE CRACK-POTTERY LEADS TO SOCIAL EXTINCTION. WHAT WILL THE PEOPLE CHOSE ON THIS DAY OF TECHNOLOGICAL ADVANCE WHEN REDUNDANCY IS THE KEY ::confused:: ::confused:: ::confused:: ::confused::

deb as some minor form of economic behavior relevant to temporary and urgent need and capped by common and official law to ensure it is non usurious has always been a social form.

any economy without debtism as its bases has always made the need for debt little but null. render unto society proper economies and debt is null.

I have not read dat argument fully yet..soon. but it looks full of holes to me

Last edit: 03 Feb 2017 11:43 by mapoui.

Please Log in or Create an account to join the conversation.

- mapoui

- Topic Author

- Visitor

-

03 Feb 2017 11:51 #334307

by mapoui

we can run with this sh!t only if we accept capitalism as natural and valid, credible way of life not an exploitative piece of crap based on the nature of the relationship between owner/worker.

that bunch of crap is a natural product of that relationship in which advantage is held by the owner and he produces all kinds of crap like that to justify his exploitation of the masses of the people.

he wont tell us that given that he cannot pay the worker what he is worth then all...ALL the nasty, murderous rivers, oceans of exploitation ever since capitalism, flows directly from that relationship..between owner and worker and that the only way to stop it is to END CAPITALISM..and to place the the social power into the hands of the people..that society run with the interest of all at its base is the only way to end exploitation and for humanity to save itself

we can run with this sh!t only if we accept capitalism as natural and valid, credible way of life not an exploitative piece of crap based on the nature of the relationship between owner/worker.

that bunch of crap is a natural product of that relationship in which advantage is held by the owner and he produces all kinds of crap like that to justify his exploitation of the masses of the people.

he wont tell us that given that he cannot pay the worker what he is worth then all...ALL the nasty, murderous rivers, oceans of exploitation ever since capitalism, flows directly from that relationship..between owner and worker and that the only way to stop it is to END CAPITALISM..and to place the the social power into the hands of the people..that society run with the interest of all at its base is the only way to end exploitation and for humanity to save itself

Please Log in or Create an account to join the conversation.

- mapoui

- Topic Author

- Visitor

-

03 Feb 2017 12:59 #334308

by mapoui

what is the universe and how does encoding into it take place ::confused::

do they in fcat mean a sub encoding..like debt encoded into humans by repeated behavior ::confused::

but then if encoding for repeated behavior then that behavior is selected driven by need..or perceived need.

if at another time that behavior is perceived to be deleterious in fact and should not be engaged in, then it becomes re-selected for elimination this time. so what does coding mean...as indicated here that once coded it is so forever ::confused::

indeed that cannot be the case. if it is coded, it can be re-coded and eliminated by a new behavior that takes its place, as the old behavior is no longer engaged in. so where is the freaking law ::confused::

that is all coded amy mean..not that borrowing money is hard wired into humanity and we chaff at the bit to engage like addicts no matter what. so that when a debt merchant arrives at the market for example briefcase bulging you need to have bars and cages to hold back the frothing hordes so addicted to borrowing they want to be the first to get to the merchants table to haggle out a loan.

Debtism is not hardwired into humanity. Debtism is Jewish capitalist trickery just like that blasted piece presented above. indeed it can be argued that greed and financial trickery, to create the need for debt and be right around the corner with loans on offer, after they created they have created the need to borrow up the street

what is the universe and how does encoding into it take place ::confused::

do they in fcat mean a sub encoding..like debt encoded into humans by repeated behavior ::confused::

but then if encoding for repeated behavior then that behavior is selected driven by need..or perceived need.

if at another time that behavior is perceived to be deleterious in fact and should not be engaged in, then it becomes re-selected for elimination this time. so what does coding mean...as indicated here that once coded it is so forever ::confused::

indeed that cannot be the case. if it is coded, it can be re-coded and eliminated by a new behavior that takes its place, as the old behavior is no longer engaged in. so where is the freaking law ::confused::

that is all coded amy mean..not that borrowing money is hard wired into humanity and we chaff at the bit to engage like addicts no matter what. so that when a debt merchant arrives at the market for example briefcase bulging you need to have bars and cages to hold back the frothing hordes so addicted to borrowing they want to be the first to get to the merchants table to haggle out a loan.

Debtism is not hardwired into humanity. Debtism is Jewish capitalist trickery just like that blasted piece presented above. indeed it can be argued that greed and financial trickery, to create the need for debt and be right around the corner with loans on offer, after they created they have created the need to borrow up the street

Please Log in or Create an account to join the conversation.

04 Feb 2017 13:15 #334401

by chairman

Always tell someone how you feel because opportunities are lost in the blink of an eye but regret can last a lifetime.

cricketwindies.com/forum/

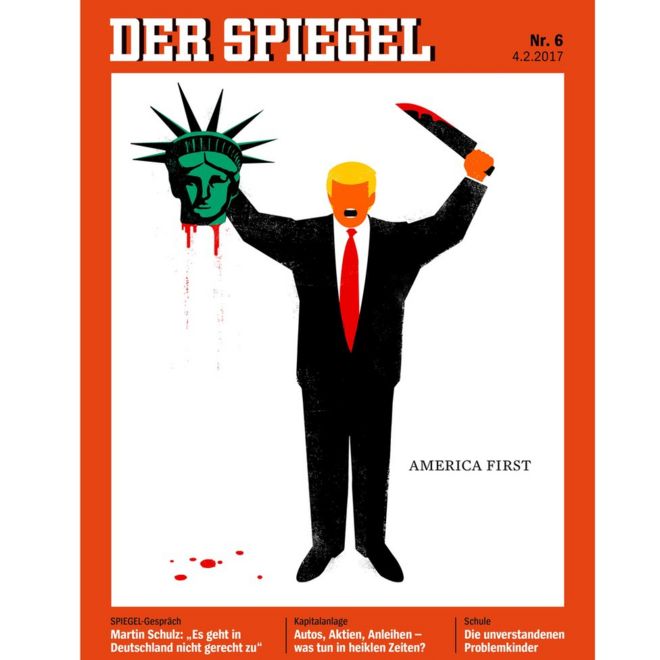

Germany's influential weekly news magazine Der Spiegel has come under fire for a cover image showing US President Donald Trump beheading the Statue of Liberty.

Some German newspapers criticised the cartoon, while the German vice-president of the European Parliament called it "tasteless".

The cartoonist, Edel Rodriguez, said the image represented "the beheading of democracy".

US-German relations have deteriorated under President Trump, who has criticised the policies of German Chancellor Angela Merkel.

He said last month that her policy of welcoming masses of migrants who arrived in Germany had been a "catastrophic mistake". His trade adviser also recently attacked Germany for gaining unfair trade advantages from a "grossly undervalued" euro.

Some German newspapers criticised the cartoon, while the German vice-president of the European Parliament called it "tasteless".

The cartoonist, Edel Rodriguez, said the image represented "the beheading of democracy".

US-German relations have deteriorated under President Trump, who has criticised the policies of German Chancellor Angela Merkel.

He said last month that her policy of welcoming masses of migrants who arrived in Germany had been a "catastrophic mistake". His trade adviser also recently attacked Germany for gaining unfair trade advantages from a "grossly undervalued" euro.

Always tell someone how you feel because opportunities are lost in the blink of an eye but regret can last a lifetime.

cricketwindies.com/forum/

Please Log in or Create an account to join the conversation.

04 Feb 2017 13:15 #334402

by chairman

Always tell someone how you feel because opportunities are lost in the blink of an eye but regret can last a lifetime.

cricketwindies.com/forum/

Always tell someone how you feel because opportunities are lost in the blink of an eye but regret can last a lifetime.

cricketwindies.com/forum/

Please Log in or Create an account to join the conversation.

- brian

- Visitor

-

04 Feb 2017 13:53 #334409

by brian

Iran, put on notice for what exactly? Another failed invasion that creates millions of new terrorists and wastes countless lives? US - the only kid in the playground allowed to hold the ball? As far as DT is concerned, if the rest of the world just ignores him for four years and trades with China, India and Russia etc...he'll eventually go away like must bullies do.

Please Log in or Create an account to join the conversation.

04 Feb 2017 14:16 #334417

by ketchim

hahahahahaha Love that Cartoon !

Beheading was indeed a European thing !!

Beheading was indeed a European thing !!

Please Log in or Create an account to join the conversation.

- King Mohunlal

- Visitor

-

04 Feb 2017 14:18 #334418

by King Mohunlal

As was expected by so many of us, Trump is now waging war against his own judicial system regarding the potentially unconstitutional travel ban.

Please Log in or Create an account to join the conversation.

Time to create page: 0.218 seconds

| ||||

Powered by The Krotek

- Menu

- Staff Login